Corporate

governance

m-sbAnchor__link

Basic approach

Mitsuuroko Group’s basic approach on corporate governance is to develop a system to ensure the appropriateness of the Group’s operations in accordance with the Companies Act, the Regulations for Enforcement of the Companies Act, the Financial Instruments and Exchange Act, other laws and regulations, and the code of corporate conduct of financial instruments exchanges. The purpose of this system is to ensure compliance with laws and regulations and social ethical norms, to ensure that Mitsuuroko Group’s business is conducted in good faith and with transparency to customers, business partners, shareholders, etc., and to fulfill the Group’s social mission in business activities.

m-sbAnchor__link

Corporate governance structure

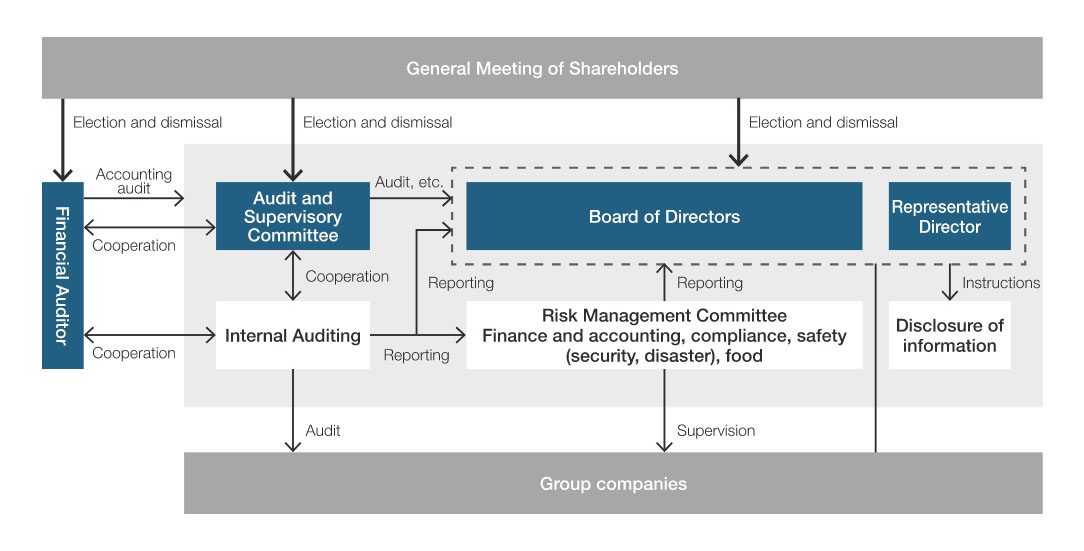

In June 2015, we shifted to a company with audit and supervisory committee and established a Board of Directors, Audit and Supervisory Committee, and Financial Auditor.

The Company has improved the effectiveness of auditing and supervision through auditing by Directors who are Audit and Supervisory Committee Members with voting rights on the Board of Directors, and further strengthened the supervisory function of the Board of Directors.

Furthermore, the management participation of five External Directors, including three Directors who are Audit and Supervisory Committee Members, enhances the supervisory function of the Board of Directors with respect to business execution and ensures the appropriateness and transparency of the decision-making process.

With regard to the Board of Directors, by holding meetings at least once a month, we are always striving to share management issues and have established a system that enables us to take action to resolve issues as soon as possible. We are also working to build a more advanced governance system by appointing diverse human resources as Directors, including foreign nationals and physicians, to incorporate multifaceted perspectives and utilize AI, IoT, and other technologies.

Moreover, in addition to appointing Directors to be responsible for the business in each segment of Mitsuuroko Group, and giving them the authority and responsibility to establish a legal compliance system and a risk management system for each Group company, the head of Finance & Control also promotes and manages these systems across the Group.

Corporate governance structure

m-sbAnchor__link

Areas where Directors are expected to excel in

The Company aims to improve corporate value to all stakeholders and achieve sustainable growth. We maintain a basic corporate governance approach to construct an optimized management structure and perform appropriate company operations.

We have composed a balanced Board of Directors by electing diverse human resources based on their knowledge, experience, and capabilities as we aim to accelerate decision-making, strengthen the supervisory function of management, and secure the transparency of company actions.

The Company expects that each Director will excel particularly in the following fields and skills.

|

Name |

Position and responsibilities |

Area or skill expected to excel in |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

Corporate management Management strategy |

Financial accounting Capital policy |

Human resources Personnel development |

Legal Risk management |

Auditing |

Internal controls Governance |

Overseas |

Social environment |

||

|

Kohei |

Representative Director and President Chief Executive Officer General management |

● | ● | ● | ● | ● | ● | ● | |

|

Kazuhiro |

Director Assistant to the President (Group Functions) Corporate Secretary Finance & Control, Legal & Secretary, Others (operational and system support) |

● | ● | ● | ● | ● | ● | ● | |

|

Takashi |

Director Assistant to the President (Group Synergy) Energy Solutions Business |

● | ● | ● | ● | ● | ● | ||

|

Manabu Sakanishi |

Director Power & Electricity Business |

● | ● | ● | ● | ● | |||

|

Jun |

Director Mobility Business, Others (leasing) |

● | ● | ● | |||||

|

Motoyasu |

Director Foods Business |

● | ● | ● | |||||

|

Goh Wee |

Director Chief Technology Officer, Chief Information Officer, Global Chief Inclusion & Diversity Officer, Global Planning, ICT Planning (Planning, maintenance, and promotion of information infrastructure), Inclusion & diversity |

● | ● | ● | ● | ● | |||

|

Katsuhisa |

Director (External) | ● | ● | ● | ● | ● | |||

|

Kaori |

Director (External) (Independent) | ● | ● | ● | ● | ● | |||

|

Hideo |

Director (External) (Independent) Audit and Supervisory Committee Member, tax accountant |

● | ● | ● | ● | ● | ● | ||

|

Yoshiyuki |

Director (External) (Independent) Audit and Supervisory Committee Member, physician |

● | ● | ● | ● | ● | ● | ||

|

Kei Tajima |

Director (External) Audit and Supervisory Committee Member |

● | ● | ● | ● | ● | ● | ||

* The above table does not display all of their expertise.

m-sbAnchor__link

Remuneration, etc. for Directors

Policy on determining the remuneration for Officers

At the Board of Directors meeting held on January 20, 2021, the Company passed a resolution for a policy on determining the remuneration, etc. for each individual Director (excluding Directors who are Audit and Supervisory Committee Members; the same shall apply hereinafter).

In addition, the Board of Directors has confirmed that the method of determining the remuneration, etc. as well as the amounts determined for each individual Director in the current fiscal year are consistent with the aforementioned policy, and are therefore judged to be in line with the policy.

The contents of the policy on determining the remuneration, etc. for each individual Director are as follows.

Basic policy

The basic policy of the Company is to determine the remuneration of Directors such that it is suitable and appropriate in light of Directors’ roles and responsibilities, taking into consideration the business performance of the Company. Specifically, remuneration for Executive Directors consists of basic remuneration and a “Board Benefit Trust (BBT),” which is a form of performance-linked stock remuneration. Remuneration for External Directors, who are primarily responsible for supervisory functions, consists solely of basic remuneration in light of their duties.

Policy on determining basic remuneration (monetary remuneration)

Basic remuneration for the Company’s Directors consists of fixed monthly remuneration and is determined after comprehensively taking into consideration such factors as remuneration levels at other companies, the business performance of the Company, and the levels of employee salaries, in addition to the positions, responsibilities, etc., of Directors.

Policy on determining performance-linked remuneration, etc. and non-monetary remuneration, etc.

At the 107th Ordinary General Meeting of Shareholders held on June 28, 2016, a resolution was adopted in relation to a “Board Benefit Trust (BBT)” as a form of performance-linked stock remuneration for Directors (excluding External Directors and Directors who are Audit and Supervisory Committee Members; hereinafter, referred to as the “Eligible Directors” in this and the following paragraph) (furthermore, the trust established based on this plan is hereinafter referred to as the “Trust”).

As set forth in the resolution, Eligible Directors are granted several points for each fiscal year, determined after taking into consideration their position, the degree of achievement of business performance targets (the degree of achievement of the target for profit before income taxes on the consolidated statement of income), and other factors, in accordance with the Officer Share Benefit Regulations (the maximum total number of points granted to Eligible Directors per fiscal year shall be 100,000 points). Furthermore, when granting the Company’s shares, etc., the points granted to Eligible Directors are converted at a rate of one share of the Company’s common stock per point (however, in the event of a share split, gratis allotment of shares, consolidation of shares, etc., in relation to the Company’s shares, the conversion ratio shall be reasonably adjusted according to the ratio thereof, etc.). The number of points for the Eligible Directors to be used as the basis for the granting of the Company’s shares, etc., is calculated by aggregating the points granted to the Eligible Directors through the time of their retirement and then multiplying the result by a predetermined coefficient set for each reason for retirement (hereinafter, the points thus calculated are referred to as the “confirmed number of points”).

If an Eligible Director retires and satisfies the beneficiary requirements set forth in the Officer Share Benefit Regulations, he or she will be granted a number of the Company’s shares corresponding to the “confirmed number of points” from the Trust after their retirement, when he or she completes the prescribed beneficiary confirmation procedures; provided, however, that in cases when the requirements provided for in the Officer Share Benefit Regulations are satisfied, the Eligible Director in question shall be paid cash equivalent to the market value of a certain percentage of the Company’s shares, in place of the granting of those shares of the Company. The amount of remuneration, etc., to be received by Eligible Directors shall be based on the amount obtained by multiplying the total number of points granted to each Eligible Director by the book value per share of the Company held in the Trust, at the time the points are granted (however, in the event of a share split, gratis allotment of shares, consolidation of shares, etc., in relation to the Company’s shares, the conversion ratio shall be reasonably adjusted according to the ratio thereof, etc.). In addition, if deemed appropriate, this amount shall be added to any money paid in accordance with the provisions of the Officer Share Benefit Regulations.

Policy on determining the ratio of the amount of basic remuneration (monetary remuneration), performance-linked remuneration, etc., or non-monetary remuneration, etc., for the amount of individual remuneration, etc., for each Director

In addition to basic remuneration, Executive Directors receive performance-linked stock remuneration (BBT), classified as performance-linked remuneration, etc., and non-monetary remuneration, etc. However, the ratio of basic remuneration, performance-linked remuneration, and non-monetary remuneration is not set in advance given the nature of performance-linked stock remuneration (BBT), such as the fact that, as described in “Policy on determining performance-linked remuneration, etc. and non-monetary remuneration, etc.” above, a number of points (a maximum of 100,000 points per fiscal year) are granted to Eligible Directors in accordance with the Officer Share Benefit Regulations for each fiscal year, taking into consideration their positions, the degree of achievement of business performance targets, and other factors, and a number of the Company’s shares, etc., that is equivalent to the confirmed number of points at the time of retirement is granted, as well as the fact that this plan was introduced in place of the payment of retirement benefits. However, basic remuneration shall be the principal remuneration for Executive Directors. Remuneration for External Directors consists solely of basic remuneration, as described in the “Basic policy” in the previous page.

Matters concerning the determination of the contents of remuneration, etc. for individual Directors

Of remuneration, etc., for individual Directors, decisions concerning the specific amount of basic remuneration are delegated to the Representative Director and President, based on a resolution of the Board of Directors. This authority covers the setting of payment standards according to positions, responsibilities, etc., and the amount of basic remuneration for each individual based on such standards. To ensure that the Representative Director and President appropriately exercise this authority, the Representative Director shall make decisions concerning the establishment of payment standards in accordance with positions, responsibilities, etc., after consulting with and receiving reports from independent External Directors.

Furthermore, the specific content of performance-linked stock remuneration (BBT) for individual Executive Directors is determined in accordance with the Officer Share Benefit Regulations.

Total amount of remuneration, etc. for FY2022

|

Officer category |

Total remuneration |

Basic remuneration |

Performance-linked stock remuneration |

Number of officers |

|---|---|---|---|---|

|

Total number of Directors |

314 | 275 | 39 | 9 |

|

(External Directors) |

(14) | (14) | (ー) | (2) |

|

Directors who are Audit and Supervisory Committee Members |

21 | 21 | ー | 3 |

|

(External Directors) |

(21) | (21) | (ー) | (3) |

|

Total |

335 | 296 | 39 | 12 |

|

(External Directors) |

(35) | (35) | (ー) | (5) |

- The amount of the above remuneration, etc. includes the provision for share awards of ¥39 million that was recorded in the current fiscal year.

- The indicator of performance-linked remuneration is “profit before income taxes” in the consolidated statement of income. This is to allow all Directors to promote a way of management that gives consideration to the continual improvement of the corporate value of the Group, by sharing returns with shareholders with the cost of capital in mind. The target value for the indicator of performance-linked remuneration in the fiscal year under review was ¥4,700 million, while the actual value was ¥11,678 million. The target value for profit before income taxes in the fiscal year ending March 31, 2024 is ¥12,000 million.

- At the 114th Ordinary General Meeting of Shareholders held on June 16, 2023, the amount of remuneration for Directors (excluding Directors who are Audit and Supervisory Committee Members) was resolved to be no more than ¥400 million per year (note that salary for employees is not included). The number of Directors at the conclusion of this General Meeting of Shareholders was nine (including two External Directors). In addition, separately from this, at the 107th Ordinary General Meeting of Shareholders held on June 28, 2016, a resolution was passed to adopt “Board Benefit Trust (BBT)” as performance-linked stock remuneration for Directors other than External Directors. The number of Directors (excluding External Directors and Directors who are Audit and Supervisory Committee Members) at the conclusion of this General Meeting of Shareholders was seven. The conditions for allocating performance-linked stock remuneration are as described in “A. Policy on determining the remuneration, etc. for Officers.”

- At the 106th Ordinary General Meeting of Shareholders held on June 26, 2015, the amount of remuneration for Directors who are Audit and Supervisory Committee Members was resolved to be no more than ¥100 million per year. The number of Directors who are Audit and Supervisory Committee Members at the conclusion of this General Meeting of Shareholders was three.

- The Board of Directors has passed a resolution that the remuneration for each Director be determined by Representative Director and President Kohei Tajima, as stated in “e. Matters concerning the determination of the contents of remuneration, etc. for individual Directors” on page 38, for the reason that Representative Director and President is eligible for evaluating the divisional performance that each Director undertakes, after considering the performance, etc. of the entire Group. Also, the total amount of performance-linked stock remuneration is reported to the Board of Directors every year through the company’s performance as soon as it is confirmed according to the prescribed rules.

m-sbAnchor__link

Cross-shareholdings

Policy on cross-shareholdings

The Company’s policy is to hold shares that contribute to improving corporate value over the medium- to long-term, after comprehensively considering their importance in relation to its business strategy, relationships with business partners, and other factors. Each year, the Board of Directors carefully examines the significance of acquiring and holding each individual stock and their profitability based on the cost of capital, etc., thus regularly verifying the appropriateness of holding these stocks. Furthermore, the Company has established a policy of selling any stocks that it is unable to recognize the rationality of holding as a result of verifying the significance and purpose of holding them and will take steps to reduce the number of such shares that it holds.

Standard for exercising voting rights for cross-shareholdings

The Company appropriately exercises voting rights based on a comprehensive assessment of whether to vote for or against each proposal, taking into consideration factors such as the establishment of appropriate corporate governance structure, the improvement of the corporate value of the investee over the medium to long term, and the impact on the Company. If necessary, we will discuss the content of proposals, etc., with issuers.

m-sbAnchor__link

Evaluation of the effectiveness of the Board of Directors

The Company has conducted self-evaluations of the effectiveness of the Board of Directors in the form of questionnaires to Directors. The Company endeavors to ensure objectivity by seeking advice from attorneys and other experts as appropriate in relation to the preparation of the questionnaire and the analysis of evaluation results.

|

Target |

All 12 Directors |

|---|---|

|

Method |

Questionnaire format |

|

Evaluation |

5-point evaluation + free comments |

|

Evaluation items |

1. Composition and operation of the Board of Directors 2. Management and business strategies 3. Corporate ethics and risk management 4. Dialogue with shareholders |

Summary of evaluation results for FY2022

According to the results of the questionnaire, the Board of Directors of the Company in FY2022 was evaluated to be effective.

The details are as follows.

The Company will work to improve these points in the future.

|

Particularly appreciated points |

The Board of Directors operates effectively in an atmosphere that encourages candid and open-minded discussion. |

|---|---|

| It has an appropriate composition of members that ensures the knowledge, ability, experience, and diversity necessary to fulfill the roles and responsibilities of the Board of Directors. | |

| Its agenda items contain sufficient content for deliberation in light of the level of importance of the matters to be discussed. | |

| Its cross-shareholdings are appropriately examined. | |

| Important risks are reported to the Board of Directors in a timely and accurate manner and the Board of Directors is aware that these issues are being addressed appropriately by the management team. | |

| The results of the audit of the effectiveness of the internal control system are reported in a timely and appropriate manner. | |

|

Recognized issues |

The content and volume of materials used at the meetings of the Board of Directors and the timing of prior distribution and explanation should be considered more carefully |

| Important management and business strategies should be reviewed from a more multifaceted and sustainability-oriented perspective and monitored more effectively. | |

| Business portfolio reviews and capital and human resource investments should be more strategically implemented and such implementations checked. | |

| A more appropriate system should be established to promote constructive dialogue with shareholders. |

m-sbAnchor__link

Status of the risk management system

Mitsuuroko Group has established the “Risk Management Committee” as a subordinate body of the Board of Directors to ensure the early detection and resolution of various problems related to legal compliance and to develop the systems required to implement and supervise internal control over legal management and compliance with laws, regulations, and social norms (compliance) in the midst of a risk environment that is becoming increasingly diverse and complex as our business portfolio evolves.

In addition, the Group has established a reporting system to ensure that compliance-related information is accurately and promptly reported to the department in charge of compliance, and it will constantly develop, improve, and appropriately operate the Compliance Hotline so that all Group employees can use it properly to communicate information without employees or outsiders receiving disadvantageous treatment because of such a report.

The Risk Management Committee evaluates risks, recognizes issues, and implements operational improvements based on the recognition of issues with regard to events that may affect the achievement of the objectives set for each business process by the general managers of each division regarding all operations of the Group, and it formulates an internal control implementation plan with the approval of the Board of Directors. In addition, it supervises the progress of the plan, and in cooperation with the Audit and Supervisory Committee and the Internal Auditing Department, it determines policies for the design and improvement of the overall internal control system.

Regarding issues related to the development and operation of internal control over financial reporting, the Head of the Finance & Control performs cross-group review and coordination, and reports to the Board of Directors on the annual plan for internal control over financial reporting and its results in light of changes in the environment.

In addition, the Company has established the “Food Quality Control Committee” to manage risks related to food quality, laws, and regulations, and to manage risks related to safety in cooperation with each department.

m-sbAnchor__link

Corporate Governance Report

Mitsuuroko Group's corporate governance

- TOP

- SUSTAINABILITY

- Governance

- Corporate governance