Risk management

m-sbAnchor__link

Basic approach

Mitsuuroko Group has established risk management rules and is developing and operating a risk management system for all of its businesses.

The Group will ensure the continuity and stable development of its business through risk management practices.

We also place the highest priority on ensuring the quality and safety of our products and services, and strive in good faith to eliminate or reduce obstacles to the interests of our customers, business partners, shareholders, investors, local communities, and other stakeholders, as well as those of all officers and employees of the Group.

We are aware of our responsibility as a supplier of products and services that are widely used throughout society, and we consider it our social mission to stably supply such products and services. In the spirit of compliance, we will adhere to various laws and regulations, the Charter of Corporate Ethics, and other codes of conduct and rules, and each of us will autonomously consider what is ethically correct conduct and act according to our value judgment.

m-sbAnchor__link

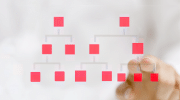

Promotion system and process of risk management

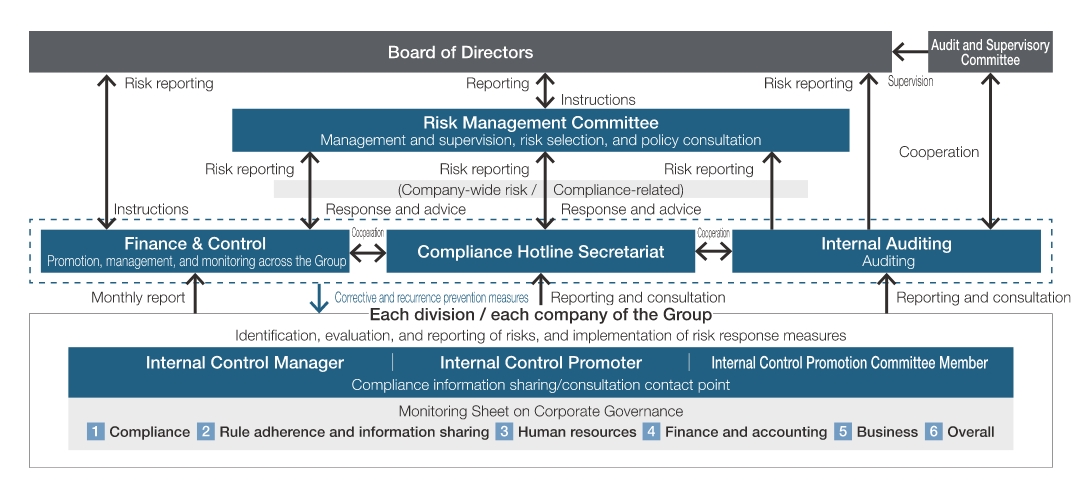

For the purpose of promoting compliance and risk management, the Group has set up a “Risk Management Committee” to supervise the risk management of the entire Group, and Finance & Control promotes and manages these across the Group. The Group has appointed an “Internal Control Manager,” “Internal Control Promoter,” and “Internal Control Promotion Committee Member” for each department to disseminate information related to compliance in each department, and to serve as a consultation contact point for employees on-site.

Regarding the risk management process, Finance & Control promotes and manages risk across the entire Group, and reports monthly to the Board of Directors risks reported by the Group to prevent problems before they occur. With regard to detected risks, if a Company-wide response is deemed necessary, taking into consideration the monetary impact and importance of the risk, the Risk Management Committee discusses the response, and the Board of Directors makes a final decision on the matter and considers and implements specific measures to address it.

m-sbAnchor__link

Monitoring

Through the Monitoring Sheet on Corporate Governance, Finance & Control visualizes the risks that should be focused on and their priorities by accurately identifying risks for the entire Group and selecting risks that need to be addressed in a focused manner. It manages the risks related to matters such as compliance, rule adherence and information sharing, human resources, finance and accounting, and business, and report monthly to our Board of Directors to prevent problems before they occur. Throughout the year, the Company monitors risks, mainly those of particular importance, and when necessary, related departments and Internal Auditing conduct investigations to take corrective measures and prevent recurrence.

Risk management promotion system

m-sbAnchor__link

Main business risks

Risks that may affect the Group’s stock price, financial position, and business performance include the following.

Recognizing the possibility of these risks, the Group strives to avoid their occurrence and to respond to them when they do occur.

Risks |

Relevant businesses |

Degree of impact |

Risk description |

|---|---|---|---|

|

1. Demand trend |

Energy Solutions Business |

Large | Demand for petroleum products (heating oil) and LPG, the Group’s core products, generally increases when temperatures are cooler. As such weather conditions can cause net sales to fluctuate and affect the Group’s business performance. |

|

2. Product procurement |

Energy Solutions Business / Power & Electricity Business |

Large |

The cost of sales of petroleum products, LPG, and electricity, the Group’s core products, may fluctuate due to changes in crude oil prices and CP of LPG, trends in foreign exchange rates, and wholesale electricity market prices through electricity supply crunch caused by inclement weather and international conditions, etc., which may affect the Group’s business performance. To mitigate these risks, attempts are made to hedge transactions using futures and other instruments and to diversify procurement sources as necessary, but these risks cannot be completely avoided. |

|

3. Sales strategy |

Energy Solutions Business / Power & Electricity Business |

Medium |

The Group’s core businesses are the Energy Solutions Business, which sells household energy such as petroleum products, LPG and related equipment, and the Power & Electricity Business, which generates renewable energy such as wind power generation and biomass power generation and conducts electricity retail for general households. Competition among competitors for customers is intensifying due to greater freedom of choice in energy and maximum price curtailment, among other factors, and a decrease in the number of customers and drop in sales prices due to these factors may affect the Group’s profitability. |

|

4. Disasters etc. |

Energy Solutions Business / Power & Electricity Business |

Very large |

Each of the Group’s business sites includes petroleum product and LPG storage facilities, power plants, and other facilities. Although the Company conducts periodic inspections in accordance with laws and regulations, inspects facilities through a voluntary safety system, and makes periodic repairs, a major earthquake or other disaster could cause a leakage accident or damage to assets. |

|

5. Investments etc. |

All businesses | Medium |

In order to strengthen its management base, the Group establishes subsidiaries or affiliated companies in Japan and overseas, and enters into capital tie-ups with external parties. With regard to investments, etc., we make decisions after giving due consideration to investment risks, etc., and periodically check the possibility of recovering the investment value. However, if the financial conditions and business performance of the investee deteriorate due to changes in the business environment or unforeseeable circumstances, and the possibility of recovering the investment decreases, or the stock price falls below a certain level, we may incur a partial or total loss on our investment, which may affect our financial condition and business performance of the Group. |

|

6. Non-current assets |

All businesses | Medium |

The Group owns a number of business fixed assets, all of which are essential to the conduct of its business and are recognized as generating sufficient cash flow in the past and present. Although we regularly check the possibility of recovering the value of our investments, future trends in land prices and changes in the Group’s earnings situation may affect our financial position and business performance of the Group. |

|

7. Laws and regulations |

All businesses | Medium |

There are a wide variety of laws and regulations that the Group must comply with in the course of its business operations. The Energy Solutions Business and Power & Electricity Business are subject to the High Pressure Gas Safety Act, the Fire Service Act, and the Electricity Business Act, etc., while the Foods Business is subject to various regulations under food-related laws and quality inspections by external public organizations. Furthermore, in the future, we may be subject to various legal restrictions, such as the introduction of greenhouse gas emission regulations and carbon taxes, amid the global demand for stronger CO2 emissions reduction efforts and decarbonization. Violations of laws and regulations applicable to the Group may hinder the continuation of our business activities due to penalties, compensation for damages, or damage to the Group’s reputation, etc. In addition, significant capital investment may be required in the future in the event of major revisions or tightening of regulations, or the establishment of regulations that are currently unforeseeable. |

|

8. Overseas Business |

Overseas Business | Large | The Group conducts overseas business in Asia, and in addition to foreign exchange risks, we are subject to risks inherent in overseas business in general, such as unforeseen circumstances arising from political, economic, and social conditions in each country, and changes in various laws and regulations, which may hinder the continuation of our business and affect our financial position and business performance. |

|

9. Spread of COVID-19 |

Foods Business / Living & Wellness Business |

Large | A decrease in customers due to a temporary shutdown of operations at the stores of the Foods Business and the hot bath facilities and bowling alleys of the Living & Wellness Business may affect the Group’s profitability. |

Risk factor by business segment

|

Energy Solutions Business |

• Fluctuation in cost of sales due to crude oil prices, CP*1/MB*2 of LPG, and exchange rates • Impact of COVID-19 on logistics infrastructure *1 Contract Price: Contracted import price; *2 Mont Belvieu: US-produced LPG price index |

|---|---|

|

Power & Electricity Business |

• Policy risks associated with changes in administrative policy and impact on system development • Necessity of procuring low cost power and developing power sources to achieve competitiveness in electric power sales • Impact of power outages caused by natural disasters on IPP business • Drop in electricity unit selling price caused by intensified competition • Impact of increased costs from obligation to offer non-fossil energy • Capacity contributions at the start of the capacity market |

|

Foods Business |

• Damage to brand image and impact on business performance in event of quality-related accident at franchised stores of store brands • Risk of decreased sales due to closing of stores in conjunction with the spread of COVID-19 |

|

Living & Wellness Business |

• Fluctuations in real estate market • Obsolescence of property in commercial facilities (Decline in competitiveness) • Delayed response to deterioration of owned real estate (Decline in competitiveness and increase in repair costs) • Risk of decrease in SPA EAS and Hamabowl customers due to the spread of COVID-19 |

|

Overseas Business |

• Risks in exchange rates • Unforeseen circumstances arising from political, economic, social and other conditions in each country • Changes in various laws and regulations • Risks inherent in Overseas Business in general |

|

Others |

• Risk receivables for lease customers arising from economic conditions, monetary policies, or the spread of COVID-19 • Impact of leakage of personal information (including specific personal information) on business performance, etc. • Risk of system outage due to system failure • Natural disaster risk and insurance underwriting risk of each insurance company arising from climate change |

- TOP

- SUSTAINABILITY

- Governance

- Risk management